- Marketers Help Marketers Newsletter

- Posts

- ROI guide for startup marketers

ROI guide for startup marketers

Marketers Help Marketers

Hello hello 👋🏽,

Welcome to this 19th edition of Marketers Help Marketers.

Quick note: This edition is landing midweek instead of our usual Sunday slot, but it's worth the wait. I’ll back to our regular schedule next week.

Here's a question you have probably been asked by your founder: "So, what's the ROI of all this?"

Your CEO wants numbers. Your CFO wants a direct line from spend to revenue. And you're sitting there with metrics that suddenly feel meaningless.

ROI is the most misunderstood, anxiety-inducing metric in startup marketing. Most of us are winging it.

That's why I sat down with Rapti Gupta, Head of Marketing at Avataar Venture Partners, fractional CMO, and former CMO at Bugasura. She's spent 13 years defending budgets at bootstrapped companies with zero CRM and funded SaaS businesses doing millions in ARR.

This edition pulls back the curtain on what ROI actually means at startups.

Fair warning: This is a long one. Read this on desktop; the frameworks and examples are easier to follow there.

Let's dive in.

Table of Contents

Chapter 1: Your job as a marketer is to walk into chaos and come back with insights

Marketing is chaotic in its own way. So are startups. But marketing at early-stage startups is chaotic at a whole new level.

You walk into a company that might not even have tracking in place. Founders want leads, dashboards are filled with vanity metrics, and the default expectation is “we want revenue.”

Rapti had a great take on this -

Your job as a marketer is to walk into chaos and come back with insights.

That's the job description no one tells you.

At Bugasura, Rapti didn't rush to buy expensive tools. They didn't even have a CRM; she used Google Sheets, set up Mixpanel with startup credits, and used LuckyOrange to understand user behavior.

The goal wasn't sophisticated tracking, but it was clarity.

Here's where most marketers go wrong: they jump into tactics and channels before understanding their ICP and what the market actually wants.

At that stage, marketing isn't just about campaigns. It's about building the system that lets you measure anything at all.

Instead of chasing perfect attribution or installing another tool, your goal is simpler: create clarity.

And clarity starts with knowing what to measure before pipeline even exists.

💡 Before you can prove ROI, you need to understand your business fundamentals. Who is your ICP? What do they actually want? How does your product solve their problem? Start there, not with attribution tools.

Chapter 2: Pipeline Minus One — The framework that changes everything

The problem with traditional pipeline measurement is that by the time you're tracking the pipeline, it's too late to course-correct.

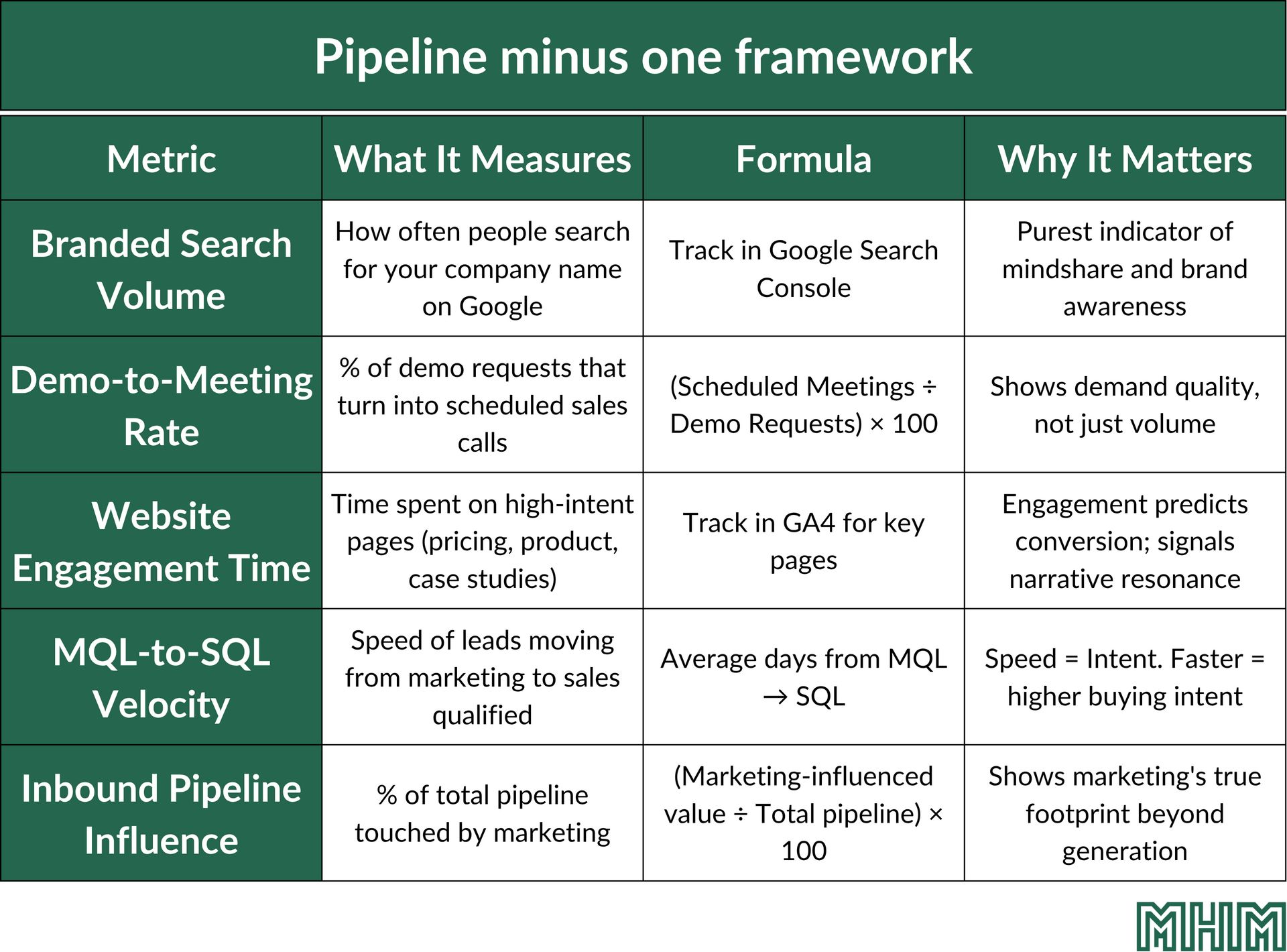

That's why Rapti uses what she calls the Pipeline Minus One framework, that uses five leading indicators that predict pipeline before it even shows up.

Think of these as your early warning system. They tell you if you're on the right track before your founder starts asking questions.

These five metrics form the core of her reporting dashboard.

They tell a story about brand health, demand quality, intent, and marketing's contribution to revenue.

The best part is you don't need fancy tools to track these. Google Sheets, GA4, your CRM, and some basic formulas will get you 80% there.

Let's break down each metric:

1. Brand Search Volume

Definition:

The number of times people search for your brand or branded keywords (e.g., “LeadWalnut pricing,” “QAonCloud reviews”).

Why it matters:

It’s the purest indicator of mindshare and brand pull. A rise here means your awareness, trust, and demand are compounding even before a lead form is filled.

How to track:

Google Search Console → Branded queries trend month-over-month.

2. Demo-to-Meeting Rate

Definition:

The percentage of demo requests that turn into actual scheduled meetings with Sales.

Why it matters:

It tells you whether your inbound demand is qualified and motivated, not just curious.

If this rate is low, you likely have a positioning or friction problem, rather than a traffic problem.

Formula:

(Scheduled Meetings ÷ Demo Form Submissions) × 100

3. Website Engagement Time

Definition:

The average time visitors spend engaging meaningfully (scrolling, clicking CTAs, interacting with key pages).

Why it matters:

Engagement predicts conversion. If people stay longer, explore product pages, or read content to depth, your narrative is resonating even if they don’t convert immediately.

How to track:

GA4 → Average Engagement Time per Session on high-intent pages (e.g., Product, Pricing, Case Studies).

4. SQL and MQL Velocity

Definition:

The speed at which Marketing Qualified Leads (MQLs) and Sales Qualified Leads (SQLs) move through the funnel — from first touch → opportunity → close.

Why it matters:

Velocity reflects alignment. If your MQL-to-SQL or SQL-to-Opportunity cycles are shrinking, it means you’re targeting the right ICP and sales handoffs are clean.

How to measure:

Average number of days from MQL → SQL → Opportunity → Closed Won.

5. % of Inbound Pipeline Influenced

Definition:

The share of total pipeline that has been touched or influenced by inbound marketing efforts (content, SEO, events, email, or brand).

Why it matters:

Not every deal starts in marketing, but strong marketing accelerates or amplifies most deals. This metric shifts the story from “marketing-generated” to “marketing-influenced.”

Formula:

(Total Value of Opportunities with ≥1 Marketing Touch ÷ Total Pipeline Value) × 100

— — — — — — — — — — — — — — — —

30-60-90 Day Credibility Framework

Here's how Rapti recommends rolling this out when you join a new company:

First 30 days: Audit What data exists vs. what's wishful thinking? Talk to stakeholders. Understand what metrics they currently use and why. | Next 30 days: Align Define one version of truth with Sales (or Product, if you're PLG). Get everyone nodding their heads about what "marketing contribution" actually means. | Final 30 days: Automate Build your pipeline dashboard. Set up your monthly business review cadence. Make it dead simple for leadership to see what's working. |

"You can't fix attribution with dashboards alone," Rapti emphasized. "You fix it by aligning incentives first."

— — — — — — — — — — — — — — — —

The beauty of the Pipeline Minus One framework is its simplicity.

You're not chasing perfect attribution. You're building confidence that your work matters before anyone asks you to prove it.

Next, let's look at how these metrics shift as your company grows.

Chapter 3: ROI in context: what happens at each stage of growth

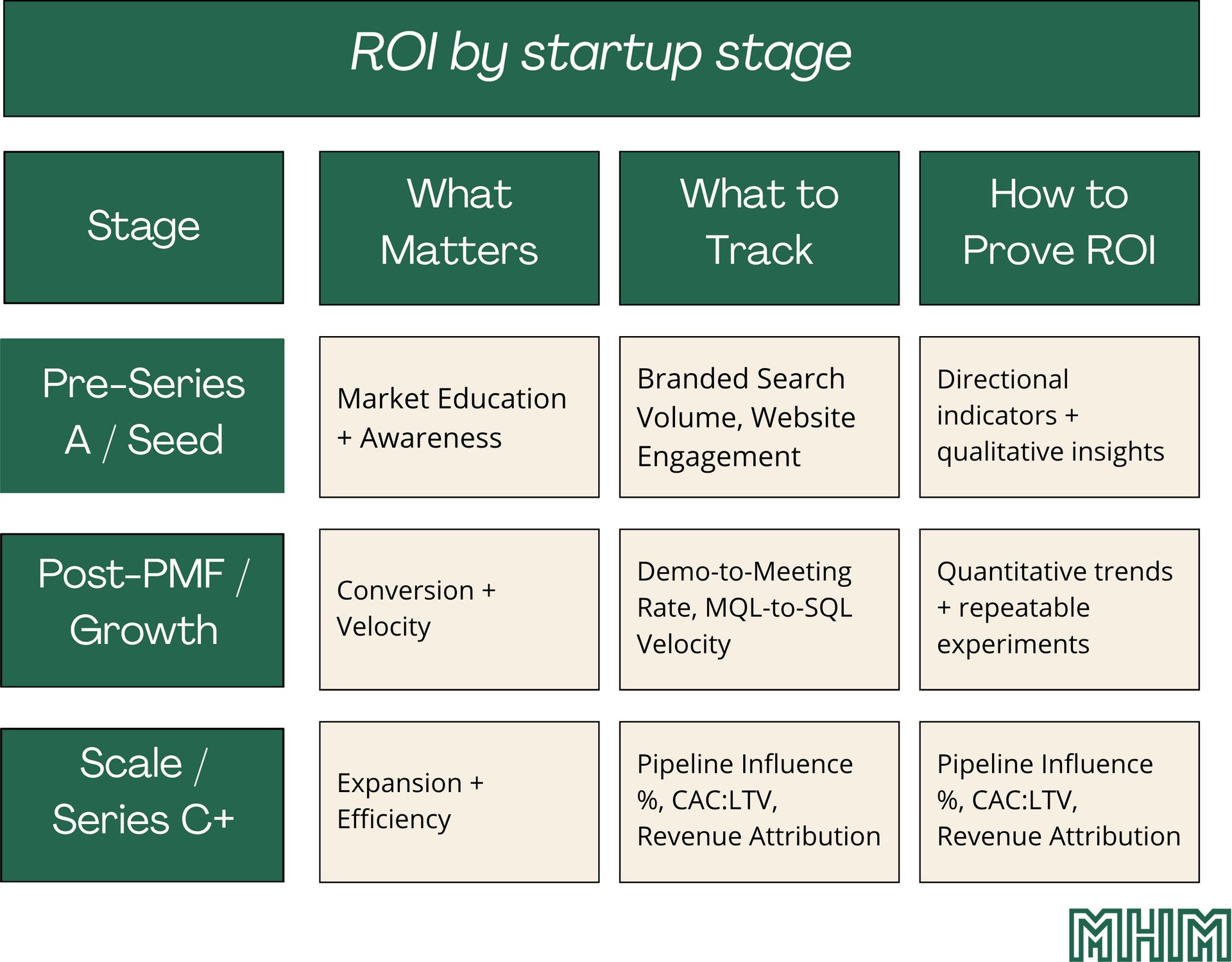

A key aspect of ROI is that it appears differently depending on where your company is in its journey.

The metrics that matter at seed stage aren’t the same ones that matter at Series C.

The story you tell your founder at pre-PMF is fundamentally different from the story you tell when you’re scaling to $50M ARR. Having worked across the entire spectrum of startups, here’s how Rapti broke it down:

Let me break down what this means in practice:

Early Stage (Pre-Series A / Seed)

At this stage, you’re not optimizing but discovering.

The key question to answer here for your founder is not CAC, but does anyone even care about the product?

Focus on proving that the market knows you exist and is paying attention. Branded search volume tells you if people remember you. Website engagement tells you if they’re interested enough to explore.

Early stage is about holding the lantern and looking in different places. You’re figuring out what works and what doesn’t. Perfect attribution isn’t the goal, clarity is.

💡 Your ROI story here is qualitative: “We ran this experiment, here’s what we learned, and here’s what it means for our positioning.”

Growth Stage (Post-PMF)

At this stage, you’re scaling what works.

The question shifts from “does anyone care?” to “can we do this repeatably?”

This is where velocity metrics shine.

How fast are leads moving through the funnel?

What’s our demo-to-meeting conversion rate?

Can we predict pipeline based on top-of-funnel activity?

“At this stage, you’re looking for repeatable success. You’ve proven the market wants this. Now you need to prove you can scale it efficiently.”

💡 Your ROI story becomes quantitative: “This channel consistently delivers X% conversion at Y cost. Here’s our 90-day trend line.”

Scale Stage (Series C+)

At this stage, you’re optimizing for efficiency and expansion.

The questions become: “How do we reduce CAC while maintaining quality?

How do we expand into new markets without rebuilding from scratch?”

Multi-touch attribution makes sense here because you have the volume and complexity to warrant it.

You’re tracking pipeline influence percentage across multiple channels and geographies.

“At scale, you’re focused on unit economics. Your investors want to see CAC: LTV ratios, payback periods, and contribution margins.”

💡 Your ROI story is sophisticated: “Our blended CAC is trending down xx% QoQ while LTV increased yy%. Marketing influenced zz% of pipeline this quarter.”

While the way you look at ROI differs at different stages of growth, there are still some constants.

You’re still gathering signals.

You’re still connecting dots.

You’re still translating marketing work into business impact.

The metrics evolve, the sophistication increases.

However, the core skill of making sense of ambiguity and building credibility through clarity remains the same.

💡 The takeaway: Don’t copy the metrics of a company two stages ahead of you. If you’re at seed stage and obsessing over multi-touch attribution, you’re solving the wrong problem. Focus on the metrics that match your maturity.

Chapter 4: The 3C Filter - How to choose (and kill) marketing channels

Every startup marketer faces the same trap: too many channels, too little budget, and a founder asking, “What about this thing I saw on LinkedIn?”

Rapti Gupta has a simple framework to cut through the noise called the 3C Filter.

Clarity: Does this channel match where your ICP actually hangs out?

Example: When Instamojo wanted to reach small business owners, they didn't guess. They knew their audience was on YouTube and Instagram, learning how to start online stores.

That clarity led to an $1,800 influencer campaign that reached 10 million people with a 60% conversion rate.

It worked because they had clarity on where their ICP actually spent time.

"We picked YouTube and Instagram because we knew this is where our buyer hangs out," Rapti explained. "Not just for marketing, but to learn how to grow their business."

Compounding: Will your investment grow over time?

If you spend on a channel today, does it build on itself? Or do you start from zero every month?

Owned channels like newsletters and community compound. Pure paid ads don't.

"Once they're in our database, they're in our control," Rapti said about the Instamojo campaign. "I can send them newsletters, invite them to events. I don't have to keep spending dollars."

Control: Do you own your audience?

Eventually, you need to stop renting attention from Meta or LinkedIn.

Bring people into your database, your community, your content ecosystem.

If the platform shut down tomorrow, would you still have access to these people? If not, you don't control it.

— — — — — — — — — — — — — — — —

Budget Allocation: The 80/20 Rule

Once you've selected channels, here's how to allocate budget:

80% to proven channels: Your workhorses. The channels delivering SQLs consistently.

20% to experiments: Your innovation budget. This is your creative oxygen.

"I treat experiments like gym reps," Rapti explained. "Light weight, short sets, track results. Even proven channels need that 20% experimental budget."

When to kill a channel

The hard part is knowing when to walk away.

You've invested time, built momentum, and you want it to work.

But hope is not a strategy.

Rapti's rule: 90 days.

If a channel isn't showing a repeatable path to SQLs in three months, kill it. Respectfully.

You're not killing your darling. You're freeing up resources for something that actually works.

— — — — — — — — — — — — — — — —

Bonus: Rapti's Top 3 channels (with a caveat)

When I asked Rapti which channels she'd pick first, here's what she said:

1. SEO + Thought Leadership Content

Not just blog posts, but content that breaks through the clutter. Content that solves problems your ICP is actually worried about.

"Create something that others aren't doing," Rapti explained. "Something your ICP talks about in private but not publicly. Bring that conversation into the open."

2. Founder-Led LinkedIn

Founders drastically underestimate this.

"Unless the founder's energy comes through, especially at early stage, you're missing a huge opportunity," Rapti said. "The founder is the one building relationships and closing deals. They need to be visible."

3. Community and Events

This doesn't mean 10,000-person conferences.

Start small, maybe a 30-person meetup or a focused dinner with 10 target accounts. Remember: quality over scale.

"At Bugasura, we spent $300 on meetups with 30 people," Rapti shared. "High-quality leads. We closed over $100,000 worth of deals from those intimate gatherings."

The caveat:

These depend on Rapti's strengths and, more importantly, what works for her ICP. Yours might be different.

"Every marketer has their own strength," she emphasized. "Play to yours. My strength is brand and content. Yours might be performance marketing or product-led growth. Own that."

The 3C Filter helps you choose channels strategically. Your unique strength helps you execute them brilliantly.

— — — — — — — — — — — — — — — —

Channel selection isn’t about doing everything. It’s about doing what works for your ICP, proving it, and scaling it, while staying curious enough to find what’s next.

Chapter 5: The AI shift - How LLMs are rewriting marketing ROI

Remember those leading indicators we talked about in Pipeline Minus One?

Brand search volume is still critical.

We're all seeing it in GA4: organic traffic is declining. However, the kicker is that your conversions might actually be increasing.

That's the paradox Rapti’s team at LeadWalnut - a modern SEO and CRO agency spotted when they surveyed 50+ enterprise CMOs for their report, "The State of B2B AI SEO Beyond 2025."

82% confirmed they'd already seen organic traffic plateau or decline. Yet many reported conversions increasing 3x.

The math doesn't add up until you realize: people aren't Googling anymore. They're asking ChatGPT, Claude, or Perplexity. And these tools don't send traffic, they answer directly, citing brands only when they trust the source.

“We stopped chasing 10,000 monthly visits.

We’d rather have 100 AI-sourced leads converting at 40 %

than 10,000 traditional visits converting at 2 %. That’s more revenue.”

The new leading indicators

In this new world, your leading indicators look different:

Mentions in AI summaries: Are LLMs citing your brand when answering category questions?

Branded queries inside AI tools: Do people ask about you in ChatGPT or Perplexity?

Direct conversions: Fewer clicks, more intent-driven visits straight to your site.

Rapti calls this the shift from traffic metrics to intent-first ROI.

The smartest teams aren't asking "How many visitors?" They're asking "How many came ready to buy?"

Your next SEO audit

Try this: Open ChatGPT or Claude and ask, "Who are the top players in [your category]?"

If your brand doesn't show up, that's your new SEO gap.

"That's the next-generation search ranking, your inclusion rate in AI answers," Rapti explained.

Your content needs to sound like how people talk to assistants: conversational, structured, built around clear answers instead of keyword lists.

Want the full breakdown?

LeadWalnut's The State of B2B AI SEO Beyond 2025 report dives into how enterprise marketers are adapting with data, tactics, and frameworks you can use today for AI search. We can all use all the help we can get to tackle AI search.

— — — — — — — — — — — — — — — —

The bottom line:

If Google gave us visibility, AI search demands credibility.

SEO is becoming less about ranking and more about representation. And marketers who adapt early by focusing on clarity, authority, and intent will own the next decade of organic growth.

Chapter 6: Using first principles as marketers

If there's one phrase Rapti repeated throughout our conversation, it was: first principles thinking.

But what does that actually mean for marketers to use first principles thinking?

For Rapti, it’s simple: ICP-based marketing is first principles thinking.

Instead of asking "what channels should we use?" or "what did this successful company do?", you start with:

Who is our customer?

What problem are they trying to solve?

Where do they hang out?

What language do they speak?

What do they need to hear to trust us?

This isn't sexy. But it works.

An example she shared of using this approach:

When Rapti joined Bugasura, they positioned themselves as a bug tracker. But through demo calls and form submissions, they noticed a pattern: people kept asking about test management features.

Instead of doubling down on their original positioning, they listened. They showed the CTO the data. They shifted the entire product strategy based on what the market actually wanted. First principles thinking meant listening to what the market actually wanted, not what they’d assumed.

"At early stage, it's very much about shifting and tilting your product strategy completely," Rapti explained. "Marketing should be helping product in that way."

That's first principles thinking. It's not about executing a playbook you downloaded from someone's LinkedIn post. It's about observing, questioning, and adapting based on what your specific ICP needs.

Here’s where frameworks beat playbooks: frameworks expand, playbooks expire.

A playbook tells you: “Post on LinkedIn at 9 am, use these hashtags, run this sequence.” It works until everyone else copies it. Then it stops working entirely.

A framework asks: “What does my ICP care about? Where do they consume information? How can I serve that need in a way no one else is?”

Rapti’s advice cuts through the noise: stop chasing tactics that worked for someone else’s ICP in someone else’s market.

Original thinking is first principles thinking. And in a world drowning in AI-generated playbooks, originality is your only moat.

Chapter 7: Having the ROI conversation - what your founder actually wants

When your founder says, "I want leads," here's what they are actually asking: I want revenue. More demos. More deals. More growth.

But that’s also what most marketers miss: they start building dashboards before understanding what kind of revenue story the founder actually wants to see.

Before you build anything, Rapti suggests asking one critical question: "Do you want control, clarity, or quality?"

This single question forces alignment on what success actually looks like.

Control | Clarity | Quality |

|---|---|---|

- You’ll spend time building detailed dashboards on attribution, showing exactly how every dollar moves through the funnel. - It’s high-effort, high-visibility work. | - You’ll focus on directional truth, running experiments, scaling what works, tracking one North Star metric that everyone understands. - Less granular, more momentum. | - You’re optimizing for the right leads, not more leads. - Intent over volume, i.e, conversions over traffic. |

Most founders haven’t thought through what they actually need. Your job is to make them think.

This single conversation sets expectations and prevents the dreaded “what are you even doing?” question three months in.

When data is messy (and at startups, it always is), keep attribution simple. Rapti’s credibility hack: frame work as experiments with clear before-and-after outcomes.

Schedule time in week one to ask foundational questions.

What’s the bigger goal?

Why this market?

Why not others?

Then set up quarterly check-ins on vision, value, and market.

Don’t wait for founders to ask about metrics. Show up with answers before questions arrive. The marketers who earn trust are the ones who absorb chaos and return with clarity, not the ones who deflect with “I’ll check and get back to you.”

Chapter 8: What to do this week?

Here's where we bring this home.

You've read about frameworks, metrics, and mindsets. But what can you actually do right now to improve how you think about and prove ROI?

1. Start with an audit

Go back to your marketing stack. Look at your attribution hygiene.

Where is the data coming from? What are your sources? Just clean it up.

Then, create one dashboard that both sales and marketing (or you and your founder) can understand. Keep it simple:

Signups (or leads)

Demo/meeting bookings

Pipeline influenced by marketing

CAC (if you're tracking spend)

1-2 brand health metrics (like branded search volume)

That's it. Don't overcomplicate it.

2. Have the "control, clarity, or quality" conversation

Talk with your founder if you haven't already. Get aligned on what they actually need from you.

3. Check if you show up in LLM results

Go to ChatGPT or Claude and ask, "Who are the top players in [your category]?" If you don't appear, that's your new SEO priority.

4. Schedule 30 minutes with your founder or sales lead to ask:

"What does a qualified lead look like to you?"

You'd be surprised how often this hasn't been defined clearly. Getting alignment here prevents the "why aren't these leads converting?" conversation later.

These may not look like they spark aha moments, but they will lay the foundation for everything you do in terms of ROI.

Closing thoughts: ROI is a story

I keep coming back to this from chat with Rapti:

ROI isn’t a number. It’s a story.

It’s the story of how well you understand your customer, your product, and your founder. It’s the story of how you translate your work into business clarity.

The marketers who win aren’t the ones with the fanciest dashboards or the most complex attribution models. They’re the ones who can confidently say: “Here’s what we did, here’s why it mattered, and here’s what we’re doing next.”

A few final thoughts to carry with you:

1. Your job as a marketer is to walk into chaos and come back with insights. That's the real job description no one tells you.

—

2. ROI starts before pipeline. Track leading indicators (brand search, demo-to-meeting rate, engagement time) not just lagging ones.

—

3. First principles thinking = ICP-based marketing. Start with who your customer is and what they need, not what worked for someone else's ICP.

—

4. The 3C Filter for channel selection: Clarity (does it match your ICP?), Compounding (does it build over time?), Control (do you own the audience?).

—

5. Budget like this: 80% to proven channels, 20% to experiments. Even your winners need that experimental edge to stay sharp.

—

6. Give any channel 90 days. If there's no repeatable path to SQLs in three months, kill it respectfully and move on.

—

7. Ask your founder one question: "Do you want control, clarity, or quality?" This single conversation prevents months of misalignment.

—

8. Simplicity compounds. Complexity signals uncertainty. The simpler your attribution, the easier it is to defend and improve.

—

9. In the AI era: intent > traffic. 100 high-intent AI-sourced leads converting at 40% beats 10,000 visits converting at 2%.

—

10. Trust is the unlock. Without it, no amount of data will save you. Build credibility by translating every marketing activity into business impact before anyone asks.

— — — — — — — — — — — — — — — —

Want to hear the full conversation?

This is one of the biggest newsletters I've written to date. And I feel like I've barely scratched the surface.

Every five minutes with Rapti, I was scribbling notes. The examples, the frameworks, the Easter eggs hidden throughout. It's that good.

This episode is 2.5+ hours of attribution failures, channel selection frameworks, killing campaigns, building credibility with skeptical founders, and how AI is rewriting SEO in real-time.

If you need a nudge: use Comet or Atlas to generate a summary.

But honestly, just listen.

This is one of those episodes you'll want to bookmark and return to every time you are wondering about ROI problems. It demystifies the chaos. It breaks everything down to first principles. And suddenly, the most intimidating metric in marketing becomes manageable.

Yes, I recorded this, and I wrote this newsletter. And I'm telling you, it's worth your time.

That’s all for this edition of Marketers Help Marketers.

If you found this useful, forward it to another marketer who’s fighting the same ROI battle today.

I’d love to hear what resonated with you. What’s your biggest ROI challenge right now?

Reply back or DM me on LinkedIn.

Have a great rest of the week! ✨

Your marketer friend,

Mita ✌🏽